Using Risk Scores to Facilitate Risk Management

Managing Risk Well Brings Competitive Advantage

Risk management is often a sticky subject. Few people enjoy thinking of all of the bad things that could happen. “We don’t take risks” is a common mantra. Is there any possibility you won’t meet your objectives, commitments or economic targets? That possibility IS risk.

Companies recognize they need a strategy to control risk, but many are skeptical about its effectiveness. This doubt isn’t borne of a sense that the practice is useless, rather, it stems from the inherent difficulty in predicting risk in a meaningful and more importantly actionable manner. While some risks are known, either because they have been previously experienced or that they are commonplace in the industry, many risks simply cannot be foreseen. It isn’t until they are at the front door when business leaders realize the risks. Then, it can be a matter of cleanup and crisis management.

Companies are trying to get a handle on this future state, hoping to take advantage of big data to give them a competitive edge. Risk Management Magazine recently offered its top risk management prediction challenges for 2019. Its first prediction was that “forward-leaning organizations will use risk management as a competitive advantage.” It goes on to explain that CROs, CISOs, COOs, CCOs and others will be under pressure to quantify risks in order to “accelerate their business.” It’s not enough, therefore, to know about the risks. Companies must also be able to understand if and how those risks could impact the business and how they might be mitigated.

Organizations who digitize their risk assessments will have a leg up on their competition. They will not only be able to make better risk predictions based on more accurate and timely data, but they will also be able to make better, more confident decisions about how to respond to those risks – and spend less time doing it. The goal may be to minimize risks, but with the right data in hand, business leaders can experience real benefits, such as reducing costs and boosting customer satisfaction for increased revenue.

Failures in Risk Management

Risks will vary depending on the industry, organization and even department, but there are some shared commonalities despite all of this. An interesting report from 2008 found five types of risk management failures. While this list is a decade old and is in reference to corporate financial risks, it could be argued little has changed and these failures span every industry:

- Failure to use appropriate risk metrics

- Mismeasurement of known risks

- Failure to take known risks into account

- Failure in communicating risks to top management

- Failure in monitoring and managing risks

Many organizations still struggle with what risks to measure, likely because they aren’t sure what all of the risks are. They often miss clear and present dangers until they’ve already caused some level of damage. Live and learn, right? But even when they do know their risks, those risks may not be communicated effectively to top management to mitigate those risks or at least learn from them. Some of this is due to the fact that those risks aren’t properly measured or analyzed in a way that makes sense to top management. Without appropriate metrics, ones that are easy to understand and consume, the data may fall flat and fail to inform decisions. There is no common language for communicating the severity of these risks across multiple impact types.

Risk Scores and Logistics

When it comes to logistics, risk management involves the entire supply chain. Any event that could cause a delay, disruption, damage or otherwise compromise a shipment poses a risk. These are difficult to predict, let alone measure.

Fortunately, technology is finally catching up, providing a never-before-seen glimpse into the various risks that plague the supply chain. Technology, including artificial intelligence, machine learning and other relatively modern advancements, is making it possible to tap into massive amounts of data in the blink of an eye. Predictive analytics solutions operationalize the data, making it consumable for business leaders who desperately need it to make educated decisions. Perhaps this is why Forbes Insights research found 65 percent of senior transportation-focused executives believe “logistics, supply chain and transportation processes are in the midst of a renaissance – an era of profound transformation.”

Predictive data alone isn’t the end of the story. It’s how the information is presented that makes the real, transformative difference. Even while many risk management solutions offer cutting-edge technology, not all solutions offer a simple way to view the data to inform decisions. It may display the data better than, let’s say, a manual spreadsheet, but it still asks stakeholders to dilute it down to a level that brings value to that particular business. This requires time, some level of experience, and patience.

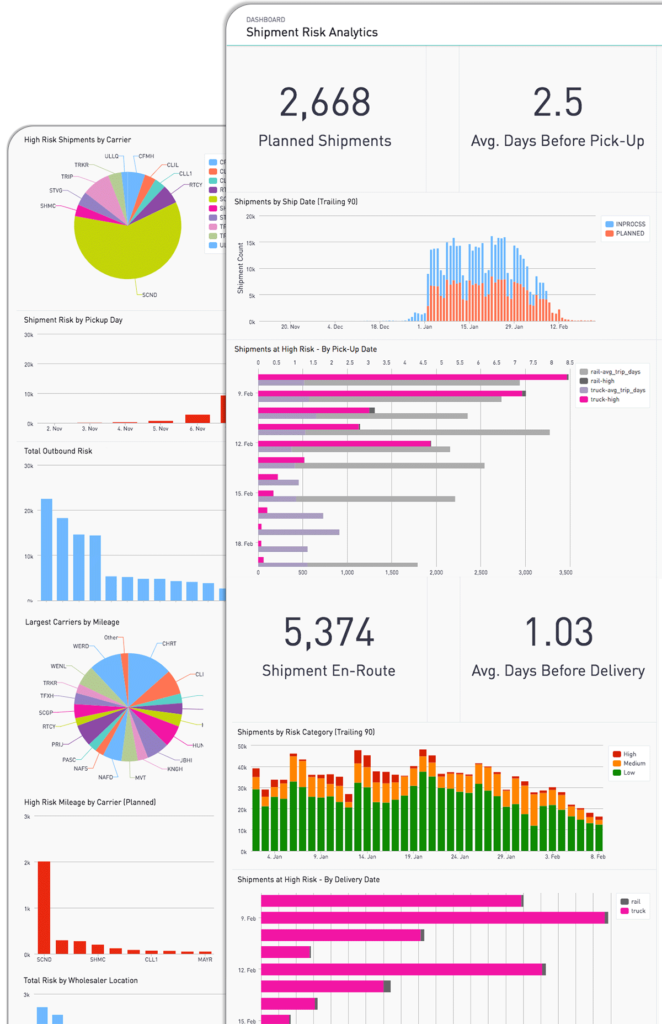

More modern transportation risk management solutions go a step further than gathering and analyzing risk data. They actually use risk scores to give viewers an instant snapshot of the probability and severity of those risks over time. This highly-actionable data speeds decisions, even a week or more before the risk is expected to cause an impact. With this data in hand, decision-makers can rapidly plan and/or execute their remediation efforts to avoid or lessen the impact.

Using Risk Scores to Make Faster, Better Decisions

Risk scoring gives companies an advantage. The scores aren’t an arbitrary number but a thoughtful representation of all of the data gathered, parsed and cleansed based on specific parameters. The scores arise by using both sophisticated technology and human intelligence – and those scores are dynamic, capable of changing as risks ebb and flow. In this way, business leaders have continuous access to real-time scores based on current conditions. They can be nimble, responsive and take the offensive instead of waiting for something bad to happen.

The types of risks considered may be inclement weather that could delay delivery anywhere along the shipping lane. It considers any extreme temperatures that may compromise freight quality, particularly grocery and pharmaceutical items with sensitive temperature requirements. Other risks that are often missed are social hazards, such as criminal activity, protests, parades, dignitary processions and other events that may necessitate an alternate route or changes in shipment dates. Infrastructure outages, natural disasters and other risks must also be included.

When these risks are evaluated relative to planned shipments, companies can foresee where their greatest risks may arise. The scoring mechanism will place a low, medium or high risk on each predicted threat, even providing details of which miles of the route may experience those risks. This framework creates a common language for communicating risk. This is not just data in a spreadsheet or a standardized report that requires human analysis. It is powerful, detailed information that decision-makers can use to make split-second decisions or as a powerful tool in the planning phase.

With this real-time data at their fingertips on a dashboard, shareable reports, or both, leaders can decide whether a shipments schedule needs adjusting, what equipment may be best to reduce spend while keeping quality intact. They can compare the risks of intermodal to over-the-road routes for the same shipment window. Even the lanes can be assessed, perhaps taking advantage of less expensive routes when conditions allow.

Resilience and Agility for A More Competitive Business

Agile transportation planning can save companies significant costs, ensure more on-time in-full deliveries, avoiding costly penalties and making the company more competitive. In essence, it affords the organization more resilience against the inevitable changes and disruptions that are bound to occur. Only with technology and intelligent risk scoring can companies make their data actionable in such a way as to drive efficiency, quality control and strategic business decisions. Forbes says, “Small wonder that a growing body of evidence suggests that the technology-infused future of transportation will arrive faster than many are expecting.”

The time is now for companies to invest in smart technology to empower risk management strategies. Modern solutions have emerged that are far more effective than legacy tools or manual efforts. With the right technology-enabled risk management solution, companies can successfully determine their risk metrics, measure all known risks, communicate those risks efficiently to top management, take mitigation actions, and continually monitor and manage those risks. Risk scores provide an extra layer of certainty to enable organizations to focus on those supply chain risk factors that are most likely to occur while they keep a close eye on the risks that may increase with severity over time.