2016-17 Winter Weather Outlook

By Jon Davis, Mark Russo, & Eric Adamchick

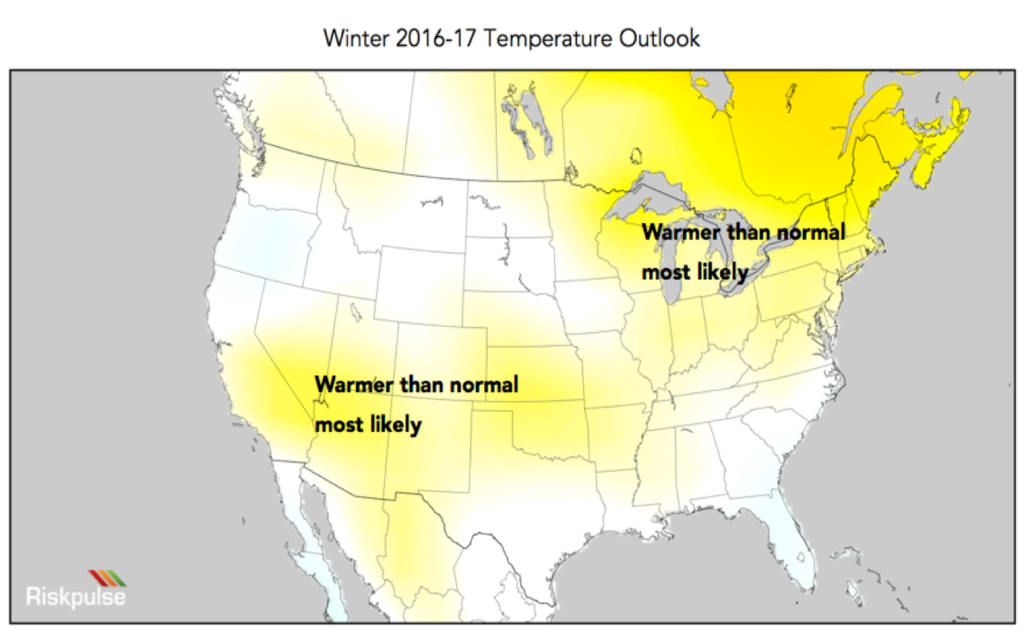

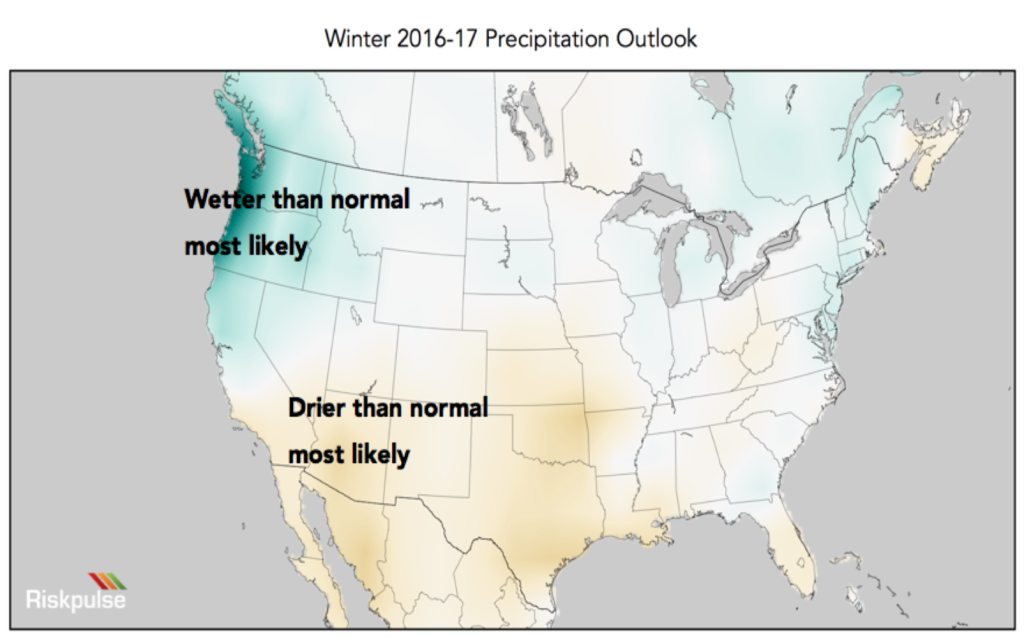

While this past summer and previous winter broke records for warmth, we do not expect the winter of 2016 – 2017 to repeat the pattern. Our current research suggests this winter will begin on the warm side across the central and eastern U.S., but will become much more variable during the core winter months of January and February. The variability is a feature for both temperature and precipitation. In other words, the theme of this winter is heightened temperature variability. Additionally, the general precipitation themes this winter will be for drier conditions south and wetter conditions north.

In terms of the temperature details, we expect more frequent and intense Arctic air intrusions into the lower 48 to occur in January and/or February as opposed to December. This assertion is based on the current and expected evolution of the polar vortex (PV), as well as the current and expected state of tropical convection across the equatorial Indian and Pacific Oceans. Furthermore, anomalously high Eurasian snow cover and the related extreme cold pooling over Siberia suggests increased cold risks across the central and eastern U.S. in January and February. Conversely, the current anomalous low North American snow cover and Arctic sea ice indicate a warm biased start to winter this December.

Winter Outlook Takeaways (U.S.)

- Last winter (2015 – 2016) and last summer (2016) were the warmest in U.S. recorded history; do not expect the 2016 – 2017 winter to continue the record-setting trend.

- While last winter was consistently warm, our research suggests this winter will be extremely variable–expect intermittent periods of unseasonably warm and acutely cold conditions.

- The primary winter storm track will be focused in the northern portion of the U.S. Northern states will have a much higher probability of major and more frequent winter storms versus the south.

- After a warm start to the winter season, the timing of the Arctic air intrusions will be concentrated in January and February versus late November and December. In other words, the window for more extreme cold is likely to open in the New Year.

- An unstable Polar Vortex and transient tropical convection / MJOs will likely drive the variable temperature and precipitation pattern this winter.

- Any stressful situations for agriculture and logistics interests will be associated with the details of the jet stream pattern in January and February. For wheat, snow cover can modulate winterkill risk, however, the exact extent and location of snow cover are unknown at this time.

Winter Outlook Takeaways (International)

- Europe/Russia is likely to remain biased on the colder/snowier than normal side this winter, as impacts from the unstable polar vortex are more likely to be felt across Eurasia than the U.S. in early to mid winter. In other words, there will be a higher frequency of winterkill risk across Europe and Russia this winter. The distribution of snow cover, which can modulate this risk, is uncertain at this time.

- The Middle East (Iran, Iraq, Turkey) will be an important region to monitor as recent dryness has taken hold across the wheat acreage. There is little prospect of this dry biased pattern tempering through the early portion of the winter.

- China is likely to feature a higher frequency of winterkill risk this winter as frequent arctic air intrusions are expected across the wheat acreage. Again, the distribution of snow cover will modulate these risks, but the details are unknown at this time.

Continue reading for sector-specific highlights. For the full report with in-depth analysis of the variables that drive this forecast, please contact us.

Sector Impacts

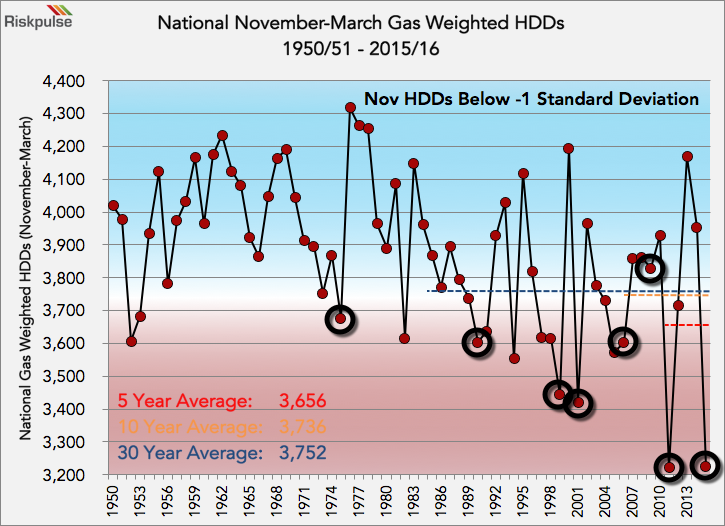

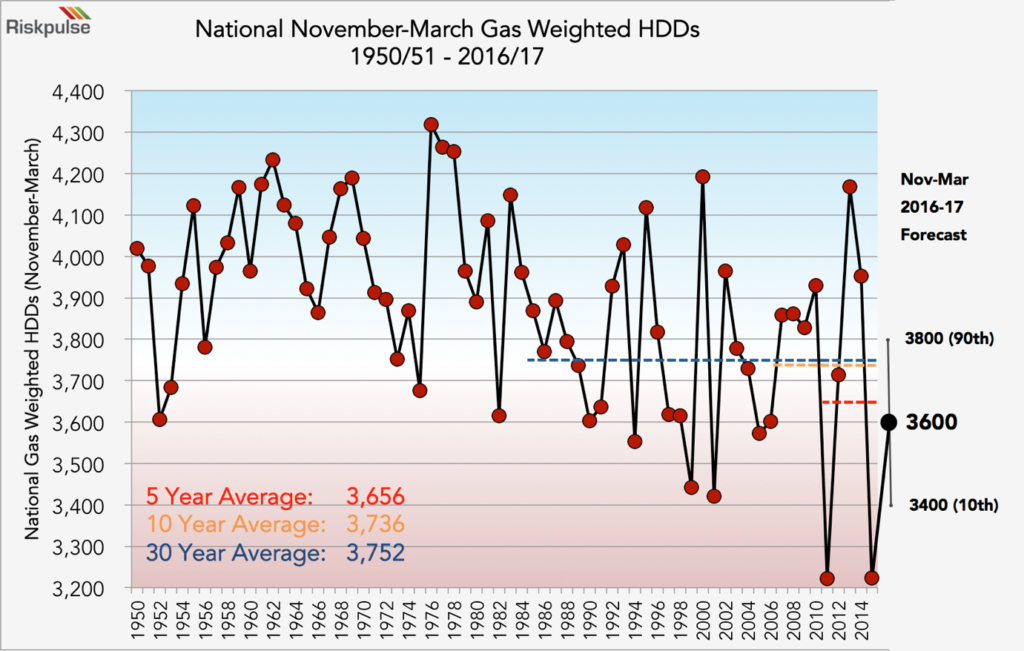

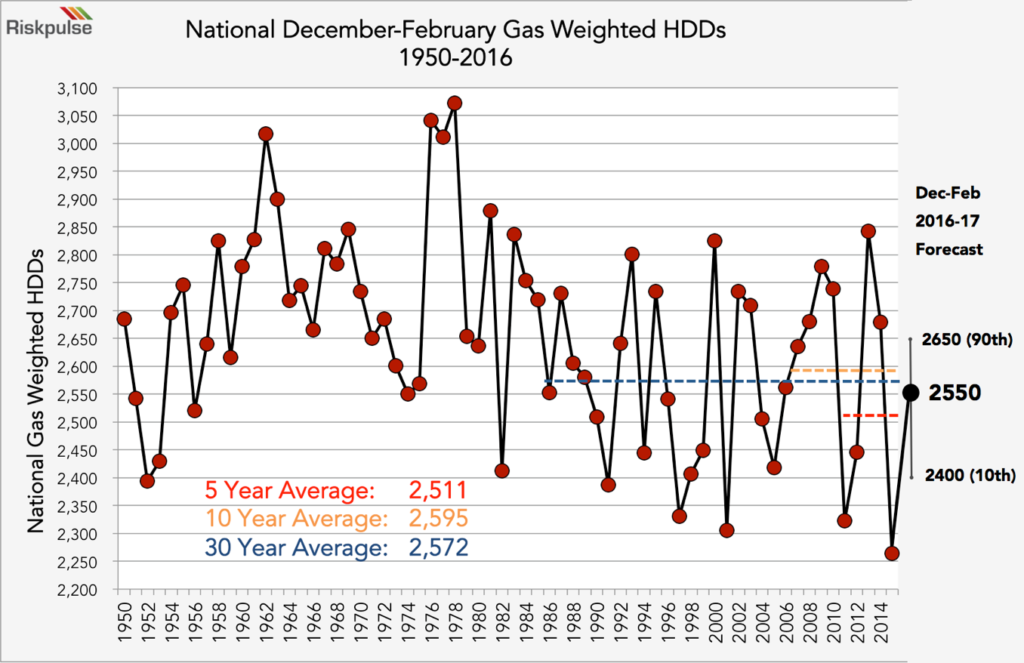

Historically, when November HDDs begin the heating season well below normal, it is difficult to climb out of that “seasonal HDD hole“ during the remainder of the heating season. During the past 30 years when November HDDs have been below -1 standard deviation from normal, November – March and December – February HDDs totals have featured a warm bias, which are highlighted below.

As a result of our temperature outlook, we expect national gas-weighted heating demand to total 3,600 HDDs with a range of 3,400 to 3,800 this November through March. This centerline forecast is below the 5, 10, and 30-year normals but higher than last year by nearly 400 HDDs. Furthermore, we expect December through February HDDs to total 2,550 with a range of 2,400 to 2,650. Please see charts below for more detail.

Ultimately, the warm biased start to winter and the mid-to-late winter temperature variability indicate heating demand will be near to below normal (warmer than normal) for the November – March and December – February periods.

Agriculture & Supply Chain Logistics

As for U.S. agriculture and logistics impacts, the expected variable temperature pattern will cause more extreme frost / freeze cycles in the winter wheat belts of the central U.S. as well as livestock interests. The primary storm track is likely to be biased across the northern tier of the lower 48, which should favor more precipitation across these regions as compared to the southern tier of the nation, which is likely to be biased on the drier side of normal. The exact extent and location of snow cover will be paramount to protect against winterkill of wheat, which is unknown at this time.

Bottom line, the devil will be in the details when it comes to potentially stressful situations for winter wheat, livestock, and commodity logistics this winter. The warm biased start to winter and the mid-to-late winter temperature variability indicate that freeze and winterkill risks will need to be monitored keenly for agriculture and logistics interests later this winter. As for Europe, Russia, and China, a higher frequency of winterkill threats are likely this winter as the PV is expected to fuel frequent Arctic air intrusions. Again, snow cover will modulate this winterkill risk, however, the exact extent and location are unknown at this time.

Summary

Based on our analysis, this winter is likely to begin warm biased across the U.S. through December before increased temperature and precipitation variability sets in for January and February. In light of the expected mid-winter variability, we do not expect this winter to continue the record warm theme featured this past summer and previous winter. The impetus for these shifting temperature regimes will be the unstable polar vortex and variability in the location of tropical convection. As a result, plan to position your business to quickly adapt to changing temperature regimes across the lower 48 this winter, particularly in January and February.

Contact us to connect with our meteorologists and receive an in-depth assessment of how your business could be impacted by the highly variable conditions this winter.