How The Supply Chain Weathered The 2017 Hurricane Season

By Jon Davis, Mark Russo, Kyle Griffin, Eric Adamchick, & Jenny Kafka

KEY TAKEAWAYS:

- The 2017 Atlantic Hurricane season, which will go down in history as one of the most active on record, caused major disruptions to the logistics, energy, and agriculture sectors: large ports were shut down, millions of customers lost power, and crops sustained billions of dollars in damage.

- The Port of Houston was shut down for nearly a week after Harvey, causing delays in shipments, 6.2 million customers in Florida were without power following Irma, and Florida alone suffered $2.5 billion in crop damage from the storm–$700 million of which is attributed to citrus crop damage, which will sharply reduce the U.S. orange juice supply.

- Quantified and context-aware risk scoring provides the complete supply chain with insights into potential storm impacts to trucking routes, stores, factories, warehouses, and farm acreage at risk of damage or disruption from each tropical cyclone.

- Regular and direct meteorological guidance well in advance of the storm enables agriculture producers to take steps to minimize crop damage, food and beverage shippers to shift production schedules or adjust shipping routes, retailers to adjust store inventories, and energy producers to move personnel onshore before storms began to impact operations.

OVERVIEW

The 2017 Atlantic Hurricane season will go down in history as one of the most active seasons on record with some of the strongest tropical cyclones ever observed in the Atlantic basin. This resulted in major disruptions to large ports, millions of customers without power, billions of dollars in crop damage, critical delays of shipments and hundreds of millions of dollars in losses for the shipping industry. The Port of Houston was shut down for nearly a week after Harvey, 6.2 million customers in Florida were without power following Irma, Florida alone suffered more than $2.5 billion in crop damage from Irma, and residents of several Caribbean islands were left without food and water after imports were stalled following Irma and Maria. Additionally, UPS reported a loss in its third-quarter earnings report, due in part to disruptions from hurricanes Harvey and Irma.

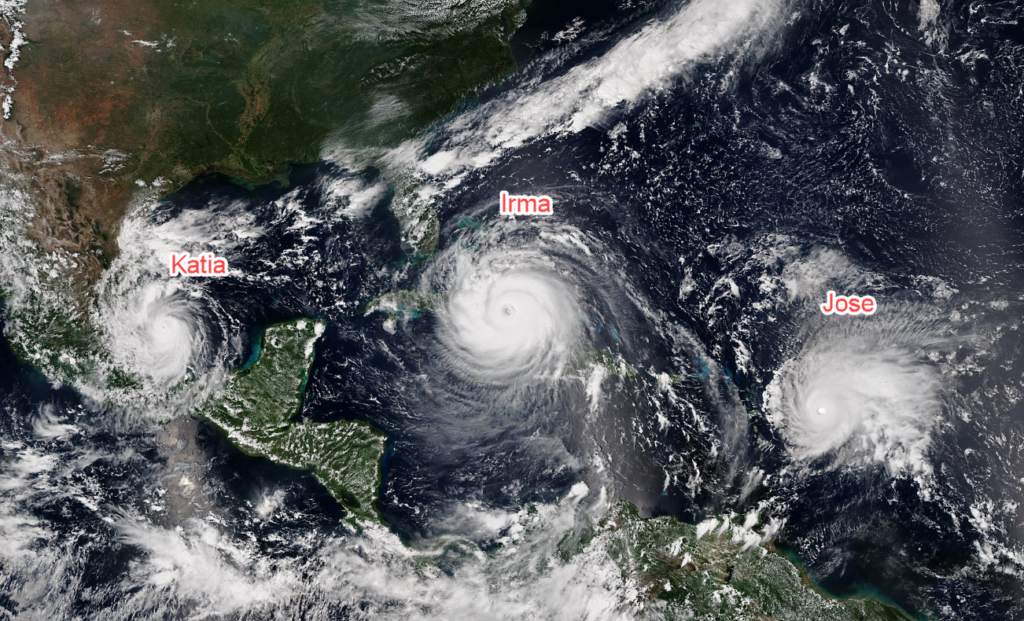

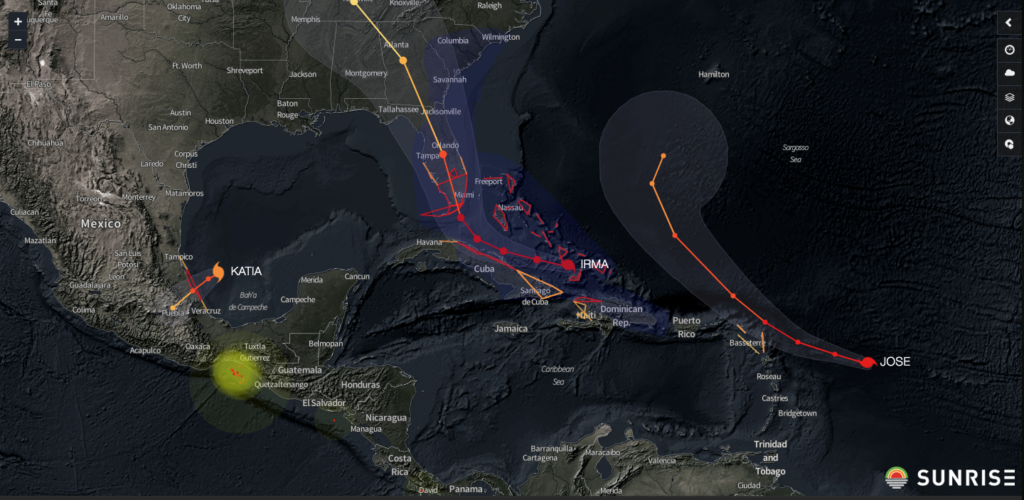

Some organizations were caught off guard by the intensity of these storms since the 2017 Atlantic hurricane season didn’t necessarily start off with a bang. There were five named storms through the end of July, but all were weak and short-lived, resulting in minimal impact to the energy, agriculture and logistics sectors. Franklin, which formed on August 7, was the first of ten consecutive named hurricanes to form, six of which became major hurricanes (Category 3 strength or stronger) and two of which became Category 5 hurricanes. While Franklin and Gert were the first two hurricanes of the 2017 season, the first hurricane to make U.S. landfall was Category 4 Harvey. Harvey was quickly followed by hurricanes Irma, Jose, and Katia–the first time three Atlantic basin hurricanes simultaneously existed in nearly 10 years.

Irma, which reached maximum strength as a Category 5 hurricane, made landfall in Florida as a Category 4 and was the second U.S. landfalling hurricane of the season. Shortly afterward, Jose and Maria avoided making landfall in the lower 48, but Puerto Rico, a U.S. territory, took a direct hit from Category 4 Maria. Even though Maria had weakened from its maximum strength as a Category 5, it managed to completely knock out the island’s out-of-date power grid. Nate made landfall at the beginning of October, and became the third hurricane to make a U.S. landfall this season, doing so near the mouth of the Mississippi River as a Category 1.

As a food and beverage shipper who distributes cargo throughout the U.S. or as a retailer with thousands of stores who relies on incoming shipments, it’s critical to understand the timing and potential impact of these hurricanes so you can take meaningful action across your network early. For these organizations, a worst-case scenario is being caught off-guard when a powerful hurricane is barreling toward suppliers, production facilities, warehouses, or customers. While general weather information is readily available online, forecasts are not contextualized for organizations’ weather-sensitive operations. The specific actions transportation teams, carriers, production facilities, or stores should take to reduce the risk of disruption are not prescribed either. While it is helpful to know that some of your organization’s stores, plants, or shipment routes are in the pathway of a potential landfalling hurricane, visualizing, quantifying, and scoring the risk of impact to each store, production facility, and shipping route enables an organization to make data-driven decisions well in advance of landfall–thus ensuring the right action is taken at each node of your supply chain network to minimize losses and disruptions.

During the 2017 hurricane season, Riskpulse meteorologists engaged regularly with clients across logistics, agriculture, and energy sectors to provide real-time updates and guidance to operations teams as soon as cyclones began to develop. As early as June, Riskpulse made note of a reversal in the cooling trend of already warmer-than-normal sea surface temperatures (SSTs) in the main development region of the Atlantic basin, where tropical cyclones generally form. SSTs in this region remained warmer than normal, and in a report issued at the beginning of August, Riskpulse predicted a high probability of stronger and more intense storms through August and September, warning that there was an elevated risk of disruptions in all three sectors and urging businesses to begin to proactively prepare for the impact of tropical cyclone activity. Clients could also routinely log in to the Sunrise platform to receive quantified risk scores reflecting the potential storm impact to their supply chain networks’ trucking routes, stores, factories, warehouses, or farm acreage. This guidance enabled agriculture producers to take steps to minimize crop damage, food and beverage shippers to shift production schedules or adjust shipping routes, and energy producers in the Gulf of Mexico to move personnel onshore, all before a hurricane began to impact the platforms. Read on to learn more about specific examples or click here to contact Riskpulse today.

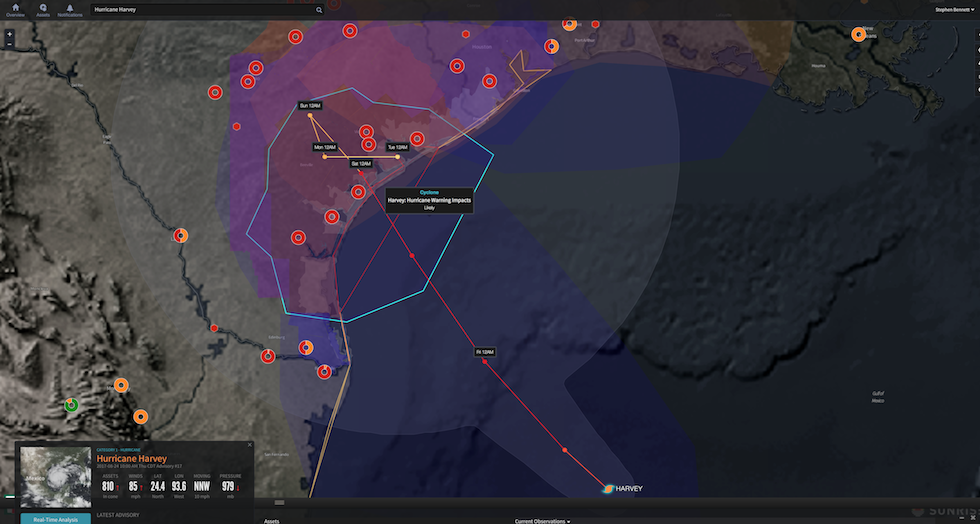

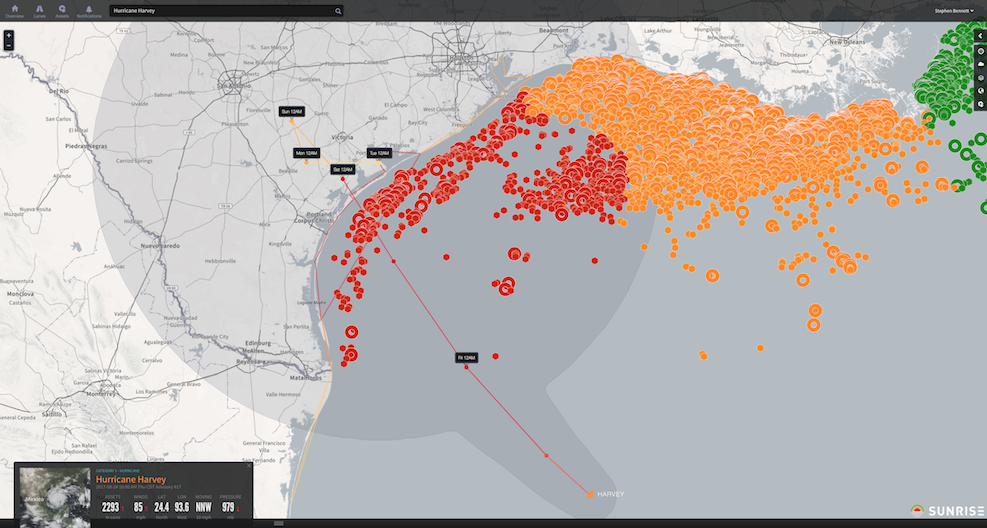

Above: A screenshot from Sunrise, depicting a customer’s assets at risk before Irma made landfall. Assets and shipping lanes are assigned low (green), medium (orange), or high (red) risk scores, accordingly to the primary threat (e.g. wind damage, flooding, or storm surge) impacting each location or lane.

HARVEY

Before becoming the first U.S. landfalling hurricane of the 2017 season, Harvey began as a tropical wave in the eastern Atlantic some 10 days earlier. Riskpulse first notified customers that the impacts in the Gulf would occur the following week. After two days as a weak tropical storm, Harvey dissipated and its remnants tracked westward, where models hinted at a possible re-development. Five days before landfall, Riskpulse raised the forecast probability of Harvey re-intensifying into a hurricane and impacting energy operations in the Gulf of Mexico to 60% and warned Harvey would likely stall out near the coast due to a lack of upper-level steering currents, significantly raising the risk of flooding from the storm.

On August 23, two days before landfall, Harvey finally re-developed into a tropical depression and the odds of impact were increased to 80-90%. Over the course of the next 48 hours, Harvey rapidly intensified from a tropical depression to a strong Category 4 hurricane. During this time of rapid intensification, customers most at risk completed the implementation of their strategies to mitigate the impact of wind, storm surge, and the expected catastrophic flooding from Harvey.

Prior to Harvey’s landfall, Riskpulse identified over 800 retail stores in the high-risk impact zone and briefed clients on the varying risks posed to assets along the Texas coastline. Clusters of locations of the high-risk retail stores are shown by the red rings on the figure on the right, along with Harvey’s forecast track. Armed with this information ahead of landfall, retail store operators proactively planned to or fully closed impacted stores, contact suppliers to delay shipments, and make plans to reopen after Harvey’s catastrophic flooding subsided.

A particular food and beverage shipper had over 1,000 of shipments at high risk of disruption over a six-day period due to Harvey. Of these, only 3% were at high risk due to the impact of hurricane strength winds and storm surge, while the remaining 97% would be impacted by the catastrophic flooding around the Houston metropolitan area. Having the context for the high risk scores due to wind or flooding for each shipment, the shipper implemented recommended actions to adjust shipment timing or routing and began notifying customers of changes to delivery schedules.

Harvey also had a significant impact on the energy market since the Gulf of Mexico provides more than 45% of the U.S.’s oil refining capacity. Riskpulse also identified more than 800 oil platforms and refineries in Harvey’s path, flagging most of them at high risk (red) and some of them at medium risk (orange). Operations at platforms and refineries could then determine when or if they should evacuate their workers onshore. About one-quarter of Gulf of Mexico oil and natural gas production was shut in, while 110 platforms ultimately decided to evacuate prior to Harvey’s arrival.

In the agriculture sector, Riskpulse alerted customers to the likely impact to Southern Texas’ cotton crop, which was exceptionally vulnerable in the open boll stage of the growing season. The copious amount of rainfall from Harvey was flagged as posing a significant risk to production losses once fields flooded.

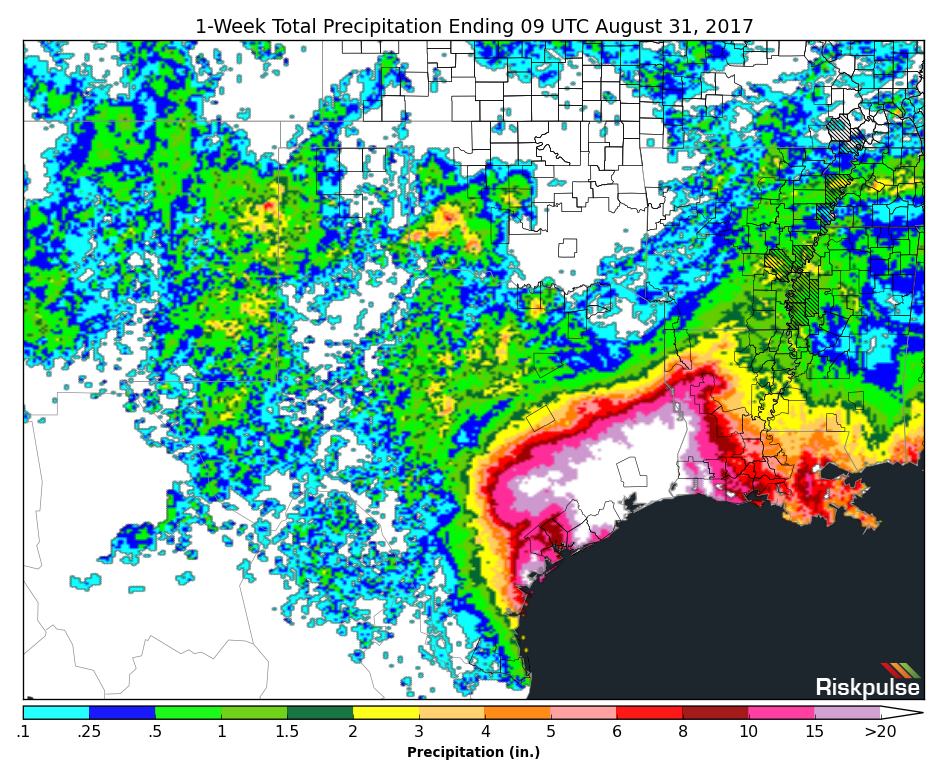

When Harvey finally made landfall near Rockport, Texas, just north of Corpus Christi, as a major Category 4 hurricane on the night of August 25, customers had already taken the appropriate measures to adjust their shipments, contact their suppliers, and close their retail stores at risk. As expected, Harvey proceeded to stall out along the coast, inundating the Houston metropolitan area with catastrophic flooding from two to four feet of rain, and locally more than 50 inches of rain, in a period of 5 days (figures on the right).

Harvey was the first Category 4 strength hurricane to make landfall in Texas in nearly 56 years. It was also the first Category 4 strength hurricane to make landfall anywhere in the U.S. in over 13 years, thereby breaking the drought of major hurricane landfalls on U.S. soil. While Harvey’s 130 mph winds surrounding the eyewall were the first phase of its impact to the supply chain, which resulted in damage to hundreds of structures, the storm will best be known for the second phase of its impact to the supply chain, the tremendous amount of rain that left the country’s 4th largest city submerged underwater for days, and disrupting thousands of shipments as hundreds of roadways surrounding the Houston metropolitan area were closed due to the catastrophic flooding and structural damage.

Houston is home to one of the nation’s largest networks of distribution centers, which serve at least six other states. In order to reduce the amount of delayed shipments from Houston’s distribution centers impacted from Harvey’s flooding, other distribution hubs in the Southeast began to supply markets that otherwise would have been supplied by the Houston hub. At the same time, trucks across the country were also being rerouted and diverted to deliver emergency supplies to Texas, resulting in a deficit of trucks in the Midwest, where shippers were trying to move warehouses filled with fresh seasonal produce.

IRMA

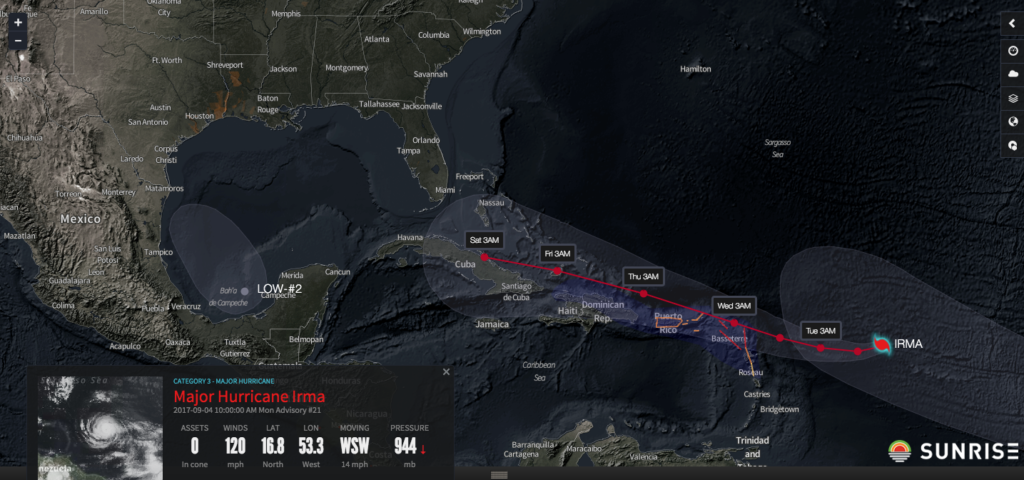

Just two days after Harvey’s landfall and while the Houston metropolitan area was experiencing its worst flood in history, customers were alerted to the development of a new tropical wave located off the coast of Africa. While the wave was still a full two weeks from impacting the U.S., the wave would become the second U.S. landfalling hurricane of the season and the first Category 5 hurricane of the season: Irma. On August 30, three days later, and eleven days before Irma’s landfall, this cluster of thunderstorms developed into a tropical storm. It was at this time that Riskpulse initially projected a system would make landfall along the Atlantic or Gulf of Mexico coastline, and ultimately impacted Florida on September 10.

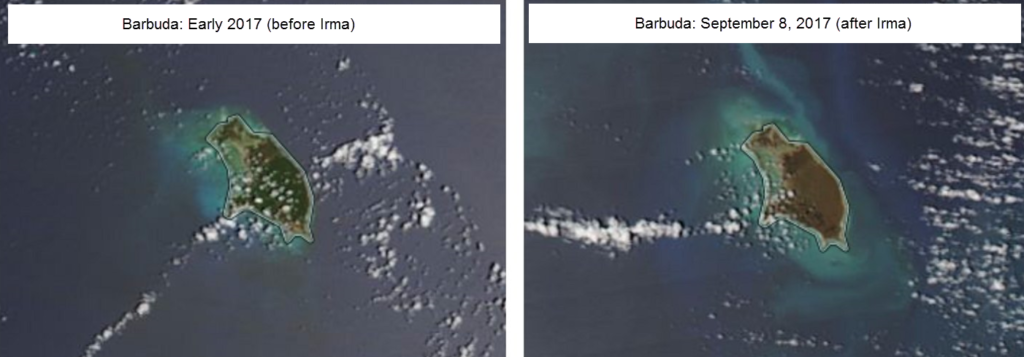

On September 6, Irma made its first landfall on the small Leeward Islands of Barbuda and Saint Martin (Barbuda is pictured below), damaging at least 95% of the structures on the islands and leaving residents of the island without power, water, or phone service. The Leeward Islands were not large enough to weaken Irma, and it maintained Category 5 strength intensity with maximum sustained wind speeds of 185 mph for an astounding period of 37 hours, breaking the previous record for maintaining such an intensity set by Typhoon Haiyan in 2013 by 13 hours. Irma then continued northwestward across the northern fringe of the Caribbean, grazing Puerto Rico and the Dominican Republic.

As Irma churned toward Florida, impacts from Harvey were still rippling through the supply chain. Around the nation, fuel prices had already jumped from disruptions to oil platforms in the Gulf of Mexico and refineries along the coast. Virginia, South Carolina, North Carolina, and Georgia, all of which receive their gas from refineries near Houston, saw an increase of nearly 35 cents on the gallon following Harvey. Furthermore, as Floridians began to prepare for the storm, several gas stations ran out of gas as they failed to meet the increase in demand.

Prior to Irma’s landfall, Riskpulse monitored the increasing risk to 2,000 of one company’s retail locations–some 10% of their total stores–and helped that customer adjust inbound deliveries for those 2,000 stores in Florida. With days of advance warning, the retailer contacted vendors and warehouses to shift deliveries earlier in order to meet increased demand from customers flocking to the stores to stock up on supplies up until a day before the storm. The retailer then shifted attention to closing stores and ensuring employee safety through Irma’s landfall.

Another food and beverage shipper relied heavily on a distribution facility in the path of Irma, and with the help of Riskpulse meteorologists, a plan was created to adjust workflows and to ensure employee safety at the facility, prior to conditions deteriorated. Further, once Irma passed, Riskpulse meteorologists were instrumental in the recovery of service at this facility by helping the client navigate flooded/closed interstates and predicting when flood waters would recede.

Riskpulse also helped a retailer identify likely shipment delays to stores well outside the path of Irma since the retailer relied on vendors with warehouses located directly in the path of the hurricane. Again, armed with this knowledge, the retailer took steps to preposition inventory from that vendor before operations went offline for five days during and immediately following the storm.

Irma was originally expected to make landfall as a Category 5 hurricane, but after land interaction with Cuba, Irma weakened and made landfall as a Category 4 hurricane east of Key West, Florida, only 16 days after Harvey’s landfall in Texas. Irma’s landfall was the first time in 166 years of recorded history that two Category 4 or stronger hurricanes made landfall in the United States in one season.

Unlike Harvey, once inland Irma was a fast moving storm and dissipated quickly after landfall. Irma, however, was a much larger storm with a wider radius of hurricane and tropical storm force winds, resulting in 6.2 million residents in Florida without electricity, as compared to 300,000 residents in Texas who lost power after Harvey. Meanwhile, Florida agriculture sustained more than $2.5 billion in crop damage, with $700 million of that coming from significant damage to the citrus crops. Since 90% of Florida’s oranges supply approximately half of America’s orange juice, the orange juice market was significantly impacted. Following Irma’s landfall, shippers and carriers faced dramatic impacts as truck capacity in the Southeast began running at 30% of what would normally be expected, leading to widespread spot rate increases and capacity shortages across the entire nation.

JOSE, MARIA, & NATE

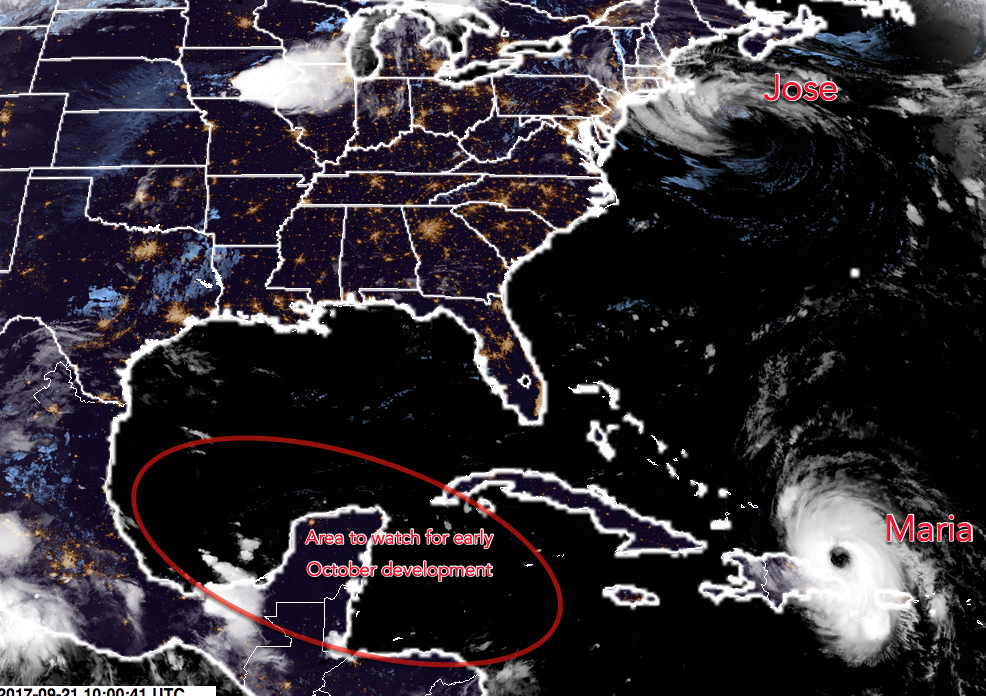

On the heels of Irma’s devastation in the Leeward Islands, Jose formed into the 10th named storm of the season in the eastern tropical Atlantic. Jose quickly intensified into a major hurricane and, for the first time in recorded history, there were two Atlantic storms with maximum sustained winds of 150 mph or greater (figure below).

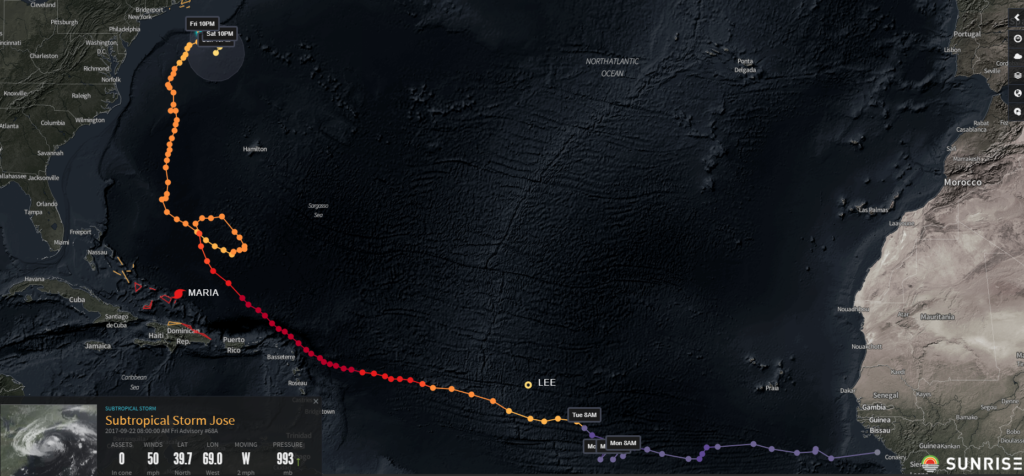

Riskpulse kept the odds of an East Coast landfall low at 15% and Jose never made landfall in the U.S. throughout its life cycle. Jose was responsible for some localized heavy rain and gusty winds along the coast, as well as energy demand destruction from rain and cloud cover along the coastal Northeast metropolitan corridor. By the end of its life on September 21st, Jose spent 16.5 days as a named tropical system, which makes it the 7th longest lived Atlantic named storm in the satellite era (since 1966).

Above: Jose’s 16.5 day track through the Atlantic.

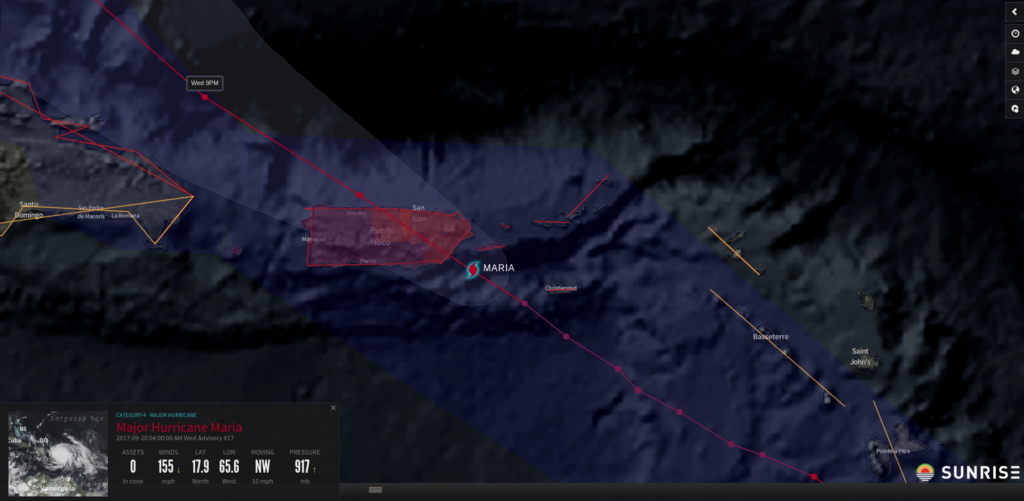

On September 16, shortly after Irma dissipated and while Jose was east of Florida, a tropical wave that had slowly been progressing westward in the Atlantic, developed into tropical storm Maria. Maria would go on to become the second Category 5 hurricane of the season and wipe out much of Puerto Rico’s infrastructure. On September 14th, two days before Maria became a named tropical storm, Riskpulse first alerted customers to the potential for this tropical wave to impact the Caribbean within the next five days. Four days later, Maria became the first Category 5 hurricane to ever make landfall on the island of Dominica.

Riskpulse kept the risk of an East Coast landfall low at 25% on the 19th; however, Puerto Rico, was not as fortunate. On the morning of the 20th, Maria made landfall on Puerto Rico’s southeast shoreline as a high-end Category 4 hurricane. Maria was the strongest hurricane to make landfall on Puerto Rico since a Category 5 hurricane in 1928!

Maria completely obliterated Puerto Rico’s infrastructure, as nearly all of Puerto Rico’s 3.4 million citizens were left without power, and millions were stranded without any drinking water or food rations. Further, approximately 90% of the country’s communication towers were uprooted, making it very difficult for relief agencies to make progress. To make matters worse, fuel, which is imported to the island, quickly became scarce, limiting the movement of aid supplies around the island. As of October 27, over a month after landfall, less than 28% of Puerto Ricans have had electricity restored and only 34% of the country’s cell towers have been brought back online.

Maria completely obliterated Puerto Rico’s infrastructure, as nearly all of Puerto Rico’s 3.4 million citizens were left without power, and millions were stranded without any drinking water or food rations. Further, approximately 90% of the country’s communication towers were uprooted, making it very difficult for relief agencies to make progress. To make matters worse, fuel, which is imported to the island, quickly became scarce, limiting the movement of aid supplies around the island. As of October 27, over a month after landfall, less than 28% of Puerto Ricans have had electricity restored and only 34% of the country’s cell towers have been brought back online.

Even though Puerto Rico imports most of their food and resources, there is a small, but important agriculture sector. After Maria’s landfall, a whopping 80% of Puerto Rico’s crop value was destroyed, which will have lasting impacts on the island’s economy.

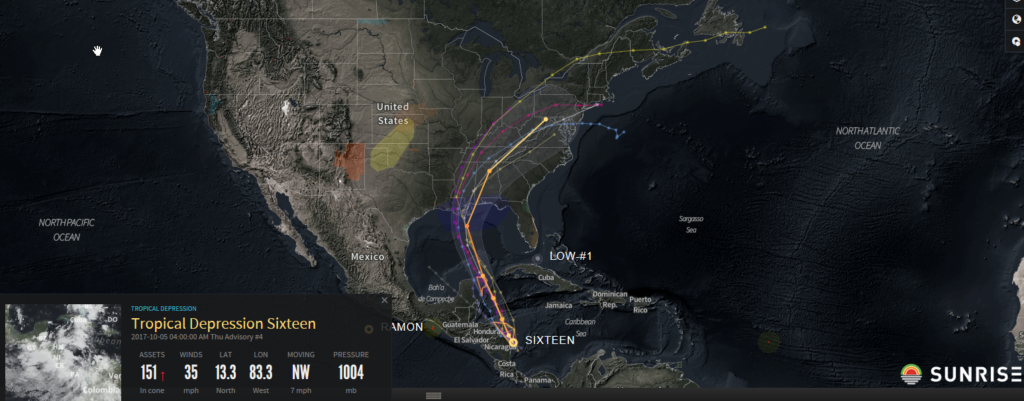

Nate formed in the western Caribbean on October 5, just over a week after Maria dissipated. Nate would go on to become the 10th consecutive hurricane of the Atlantic season as well as the third U.S. landfalling hurricane of the season.

On September 21, a full fourteen days before Nate would develop into a named storm, Riskpulse began alerting customers to the risk of possible tropical development in the in the western Caribbean or Bay of Campeche (figure on the right). Over the next week, the potential threat for tropical development persisted and Riskpulse continued to alert their customers of potential impacts, including the risk to offshore and onshore oil production in the eastern Gulf of Mexico.

On October 4, a day before Nate officially formed, Riskpulse placed the odds of this tropical wave developing into a named tropical storm at 85%, the odds of a U.S. landfall at 80%, and odds of reaching major hurricane strength at 5%.

SUMMARY

Regardless of the market sector: energy, agriculture, or logistics, organizations increasingly require insightful forecasts and guidance during the hurricane season to understand the most important actions that can be taken to minimize disruptions to operations. Data science and meteorological advisory support are becoming essential for knowing when to move personal onshore, protect crops from damage, shift production schedules, adjust shipping routes, and contact fellow members of your supply chain network to coordinate activities that avoid significant damage from these storms. By staying ahead of the storm with forecasts contextualized for an organization’s individual vulnerabilities to wind, storm surge, and flooding, teams can implement the right strategies and the appropriate time to reduce their risk of impact from any significant weather event.

Click here to contact Riskpulse today and prepare your organization for the next hurricane season.